how to become cpa lawyer

Typically CPA candidates must have at least 24 college. Once this step is completed they must.

7 Skills Cpas Need And How To Get Them Robert Half

A recent Robert Half report.

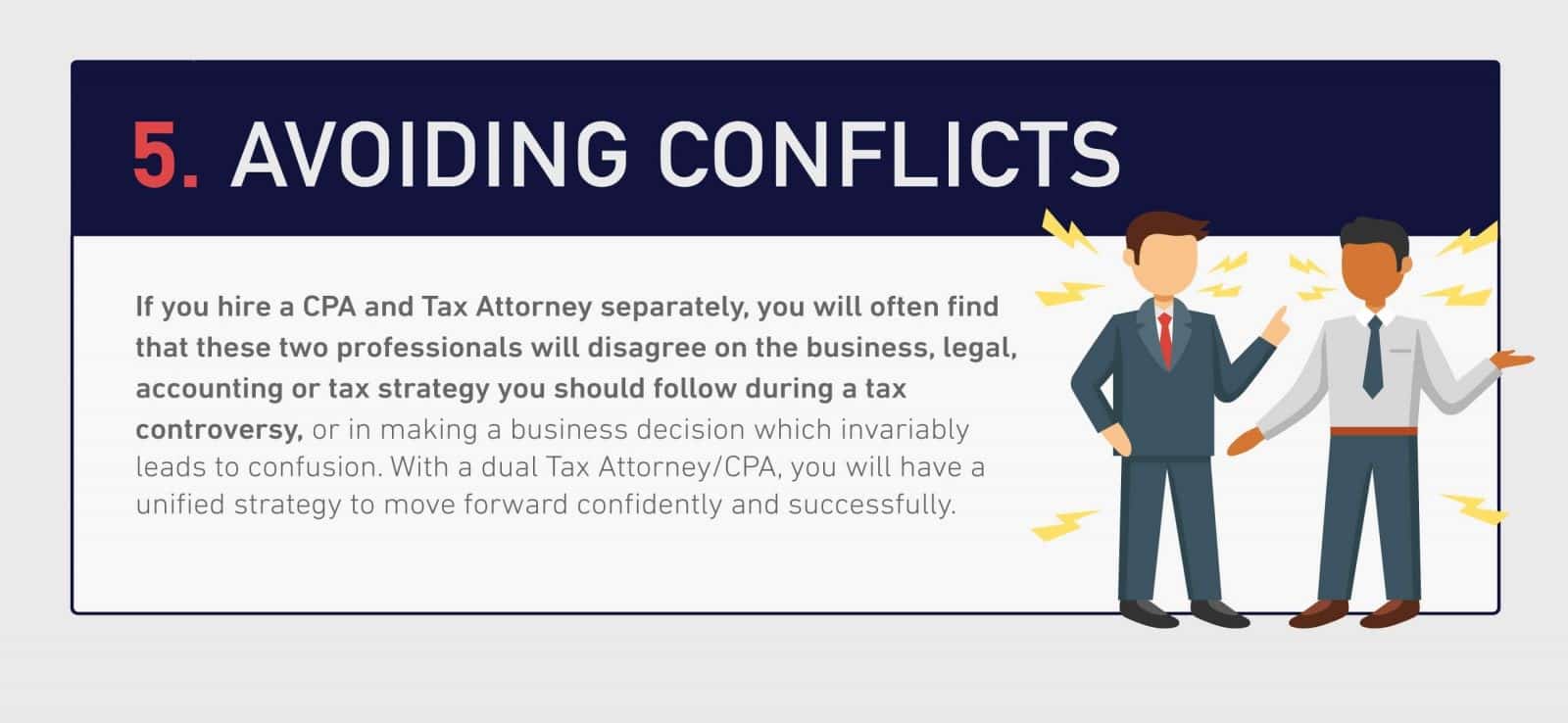

. A professional license as well as a knowledge of accounting and the law. These programs typically take four. The Power Of The Dual View.

Get a bachelors degree. Earn a total of 150 higher education credit hours. CPA candidates must hold a bachelors degree and additional educational qualifications.

Learn what it takes to become a lawyer in the Philippines with this step-by-step guide written by a Filipino attorney. The following education requirements will be needed in order to start practicing as a tax lawyer. 7 325270 Examination for certified public accountant -- Fees -- Reevaluation -- Reciprocity.

Like all CPA exam qualifications the education requirements vary across states but there are several consistencies that most states require. CPA Education Requirements. Again professional work experience requirements can vary from state to state but in general CPA.

Such a person has to pass a bar exam in those states which require it. Organize practice tests into sections based on each section of the. Take The Uniform CPA Exam.

One has to earn a pre-law degree mostly political scienceliberal arts and should pass the Board exams for lawyers. Accountant requirements include education and work experience and if you want to become a CPA there are additional testing and education accountant requirements as well. Using the study materials you have access to create a 11 representation of the CPA exam to the best of your ability.

Juris Doctor Law Degree. Since most states require 150 semester credit hours to become a CPA. Based on the passing average of both board exams becoming a lawyer is.

How To Become a Lawyer in the Philippines. Then youre officially a CPA and. Why CPAs Should Consider A Law Degree.

In most states youre required to have 150 hours of college credit. These degree programs must typically be in accounting or business and must also include a core set of coursework. Cultivate the important skills and qualities required to study law.

First apply to become a CPA Australia member complete the CPA programme meet your experience requirements make sure you have a degree. This makes the planning process. Some schools offer a combined five-year.

Becoming dually-qualified gives you far greater insight and perspective than your average lawyer or accountant. Lawyers can obtain the CPA designation by completing 150 semester hours of education at the undergraduate or graduate level. Steps to Become a Certified Public Accountant 1 Fulfill the Educational Requirements 2 Apply to Take.

By being both a CPA and lawyer my ability to understand the numbers as well as the legalities associated with estate planning help me bridge that gap. Emotional intelligence the ability to relate and engage well with others can also help you advance in your CPA career. Most states with a few exceptions require that CPAs have at least a bachelors degree in accounting or finance.

The amount of respect and trust that clients put in you when you are both a lawyer and a CPA is really unbelievable Mr Gullotta told GC. Earn a bachelors degree in accounting or another related financial field from an accredited college or university. How To Become a Lawyer in the Philippines.

Lets say that youre in high school and you want to. The exact amount of time that will take you to become a CPA will depend on your prior experience and the rules in your state. Since most states require 150 semester hours to become a CPA you may need to earn a masters degree to meet this requirement.

He may or may not be a tax attorney someone who specializes in tax issues or tax questions of law capable of litigating. Apply for a summer internship at a tax law firm after your first year of law school to gain valuable experience and increase your chances of finding employment after. Being able to see the tax effects of legal.

Once you have completed 120 of the 150 semester hours required for licensure and have at least a bachelors degree you are eligible to sit for the. 7 325280 Qualification as certified public accountant by reciprocity for foreign accountants and. Meet The Experience Requirements.

Each state sets its own educational criteria for the CPA.

Cpa Vs Tax Attorney Top 10 Differences With Infographics

San Jose Tax Attorney And Cpa David Klasing

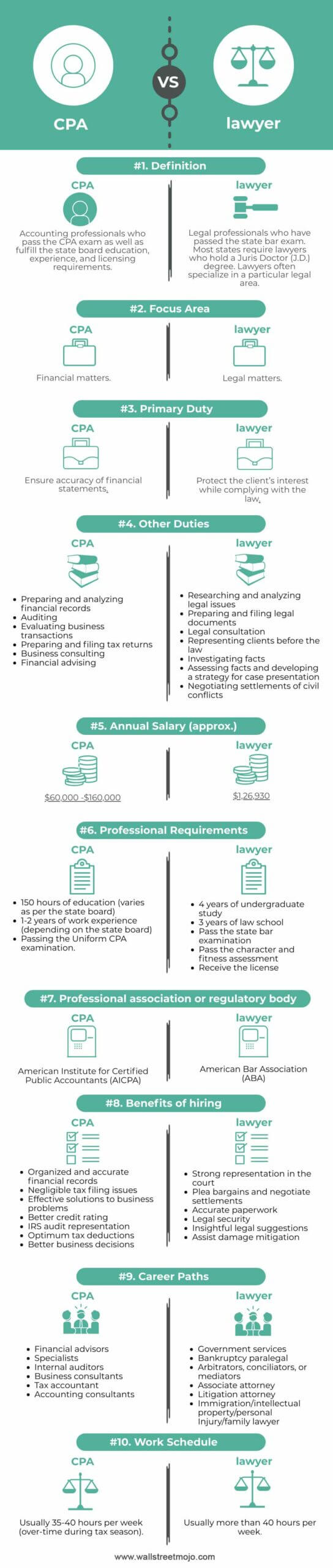

Cpa Vs Lawyer Top 10 Best Differences With Infographics

The Power Of The Dual View Cpas Should Consider A Law Degree

Cpa Vs Tax Attorney Top 10 Differences With Infographics

Why Become A Cpa Top 4 Reasons And Major Benefits 2022

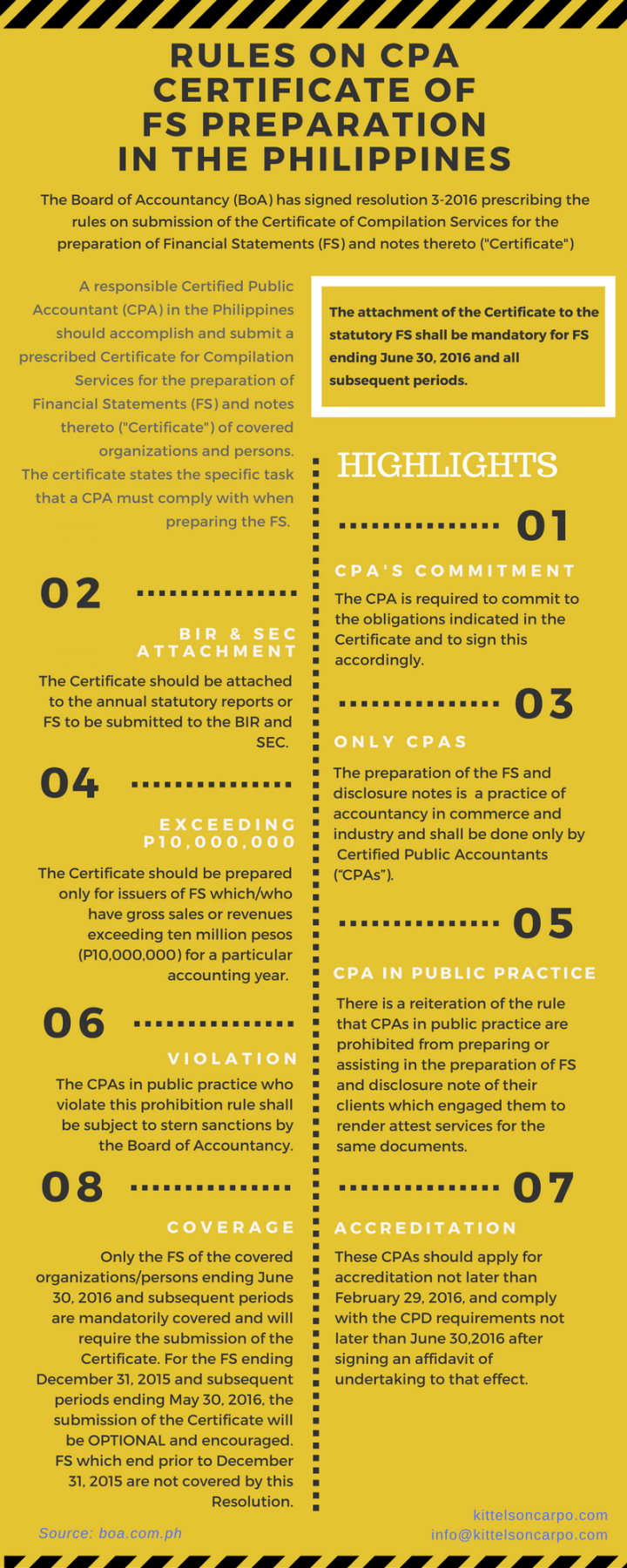

Rules On Cpa Certificate Of Fs Preparation Philippines

What Does An Accounting Lawyer Do Best Accounting Degrees

The Power Of The Dual View Cpas Should Consider A Law Degree

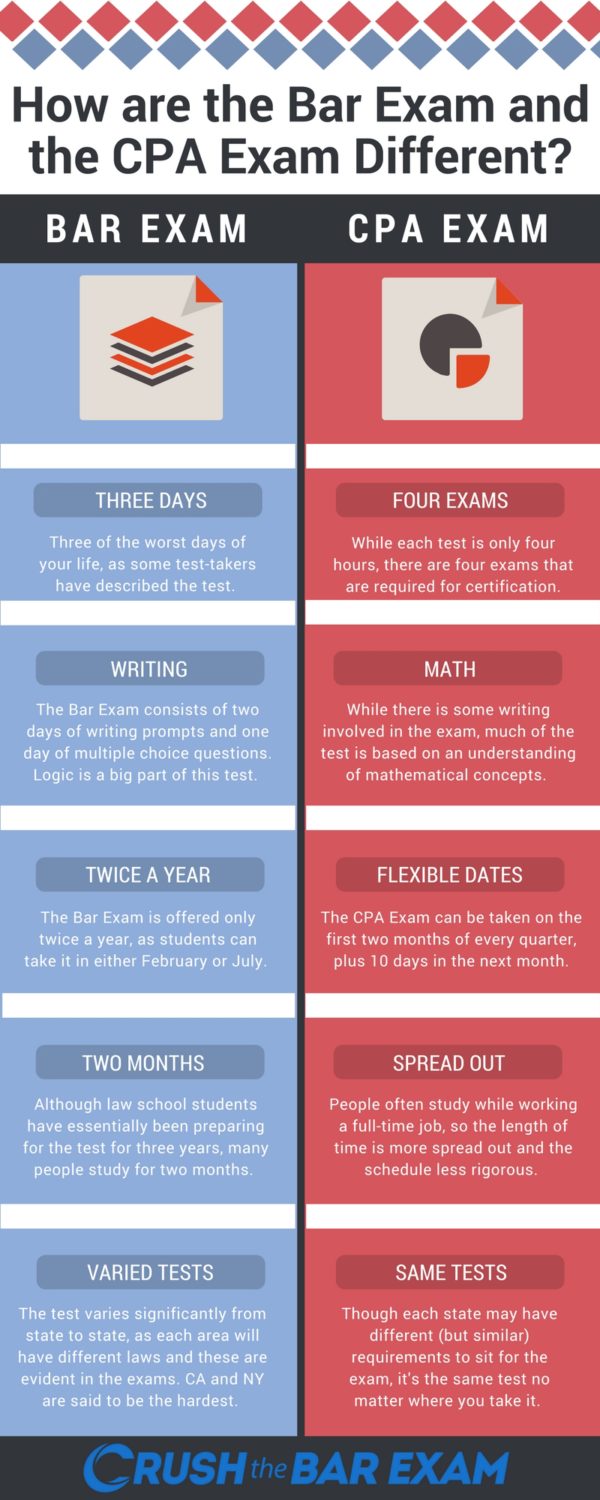

Cpa Exam Vs Bar Exam Which One Is Harder Crush The Bar Exam 2022

Differences Between Cpas And Tax Attorneys Milikowsky Tax Law

Is Studying To Become A Cpa Similar To Studying For The Bar To Be A Lawyer

Who Has A Higher Societal Status And Recognition In The Philippines A Cpa Or A Lawyer Attorney Quora

5 Disadvantages Of Being An Accountant Cpa Traceview Finance

Can I Combine An Accounting Degree With A Law Degree Top Accounting Degrees